|

Like many other households, we recently completed our tax returns for the 2018 tax year. Along the way we discovered something new as part of the 2017 tax reform law: the donation receipts we hung onto throughout the year were basically irrelevant. No longer could my wife and I individually deduct the support we provided to an array of tax-exempt, 501c3 charitable organizations. Our standard deduction would far outweigh our charitable contributions.

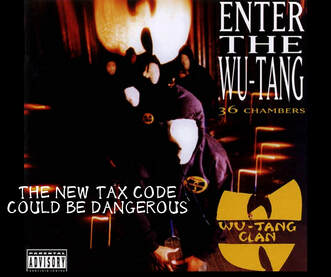

I was a little taken aback at this: Not only might it change the calculus for our giving approach, it also might change the incentive structure for the entire $390 billion nonprofit industry. Dec. 31 was always a big day for us to make those tax-deductible gifts. For nonprofits, it was a date that meant everything—one last call for donations and often a day that could make or break your annual revenue goal. So I read up on the new tax code so you don’t have to. I summarized what I found here—and what the implications may be for nonprofits—with some inspiration from the Wu-Tang Clan, which recently celebrated the 25th anniversary of the classic rap album “Enter the Wu-Tang: 36 Chambers.” Because, truly, cash rules everything around me. “It’s been 22 long, hard years, I’m still strugglin’. Survival got me buggin’, but I’m alive on arrival.” My wife and I aren’t alone when it comes to taxes this year. The number of households claiming an itemized deduction for charitable purposes is projected to drop from 37 million to 16 million, according to the Tax Policy Center of the Urban Institute and the Brookings Institution. The law increased the standard deduction to $12,000 for singles and $24,000 for couples. For anyone giving less than that—and let’s face it, that’s most of us—it’s no longer advantageous to list all the charitable gifts we made throughout the year. “If what you say is true, the Shaolin and the Wu-Tang could be dangerous” The financial repercussions for charities are potentially enormous. The Tax Policy Center estimated the new law would reduce charitable giving in 2018 by between about 4% and 6.5%, equating to billions of dollars. That’s why the charitable sector advocated vigorously against these changes. Tax incentives aren’t the only reason people give, though. Commitment to the cause and organizational impact and effectiveness are still key drivers, experts say. The Dec. 31 deadline acted as a reminder to give, but often wasn’t the main motivation. For us it was a nice tradition to look back on the year’s gifts, especially coming on the heels of the holiday season. “The Wu is too slammin for these cold killin labels. Some ain’t had hits since I seen Aunt Mabel.” How else might this not be bad for nonprofits? One fundraising friend believes that these changes won’t make much difference at all, especially for the wealthy “1% crowd” who largely won’t be affected. He also believes that foundations and corporations will continue at their same levels. Further, the new provisions sunset in 2025, and incentives actually went up for those wealthier households that itemize deductions. For the middle class itemizers, donors may “bunch” their donations into one year so that they can exceed the itemized deduction threshold and claim additional benefits. Individuals also might begin pooling money into donor-advised funds and family foundations. On the other hand, bunching and pooling would have an effect on those nonprofit cash flows, which already rely on a surfeit of funds coming in each December. “Reunited, double LP, world excited. Struck a match to the underground, industry ignited.” With a nod to “Wu-Tang Forever,” what to do about all this, aside from riding it out until 2025? My thought as a donor is to continue to make gifts in the December timeframe—on Giving Tuesday and in the last week of the year so that organizations have the cash to keep operations running smoothly. Cash does indeed rule everything around me. Nonprofit themselves should be aware of these changes and recognize that Dec. 31 may have some reduced importance. But also that people may not be that likely to change their behavior. Communicate to your supporters about the law and continue demonstrating your impact. The causes we’re working on are too important to do otherwise.

2 Comments

Angel

4/13/2019 11:01:00 am

Nice work Bob

Reply

Leave a Reply. |

The blog is a space for stories of the natural world and the occasional post about communications and strategy.

Archives

September 2022

|

RSS Feed

RSS Feed